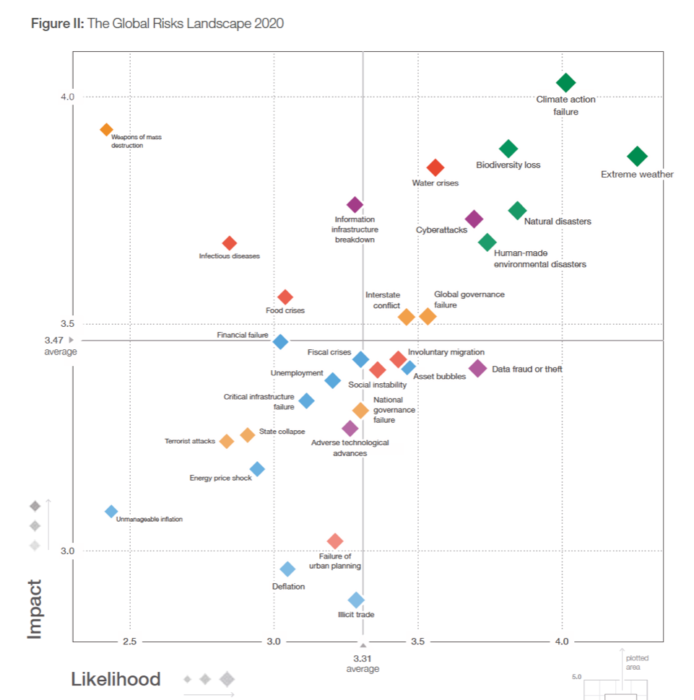

Climate change and global warming are the most important environmental risk that give rise to a whole series of consequences such as accelerated melting of glacier masses, rising sea levels, changes and interruptions in traditional seasonal climatic trends, destruction of biodiversity and increasing desertification. Here is a graph of the 2020 Global Risk Survey: in this important survey the main risks for mankind are identified. These risks are shown on the graph based on probability (x axis) and impact (y axis): as you can see, the risks at the top right (the most probable ones and with a significant economic impact) are all risks related to the environmental sphere.

Financial implications are closely linked to these environmental risks. On the one hand, there are the so-called physical risks, i.e. the risks of damage to property and infrastructure as a result of extreme climatic events. The frequency of such events is increasing and every time they happen we see the physical damage that these events bring with them. For example, the environmental event that created the greatest destruction of property in 2020 was the flood in southern China between June and July: in addition to 216 victims, it is estimated that the flood caused damage for about 35 billion USD of which only 2 billion had been insured. And we are talking not only of destroyed properties but also of environmental degradation, namely air, water and soil pollution, water stress, loss of biodiversity and deforestation.

But there is also a high type of financial risk related to climate change: transition risks. This risk indicates the financial loss that an entity may incur, directly or indirectly, as a result of the adjustment process towards a low-carbon and more environmentally sustainable economy.

Try to think what would happen if the Carbon Tax were applied tomorrow in Europe, or a tax on a company’s carbon emissions: if it has already planned a transition to renewable energy sources, it will be more advantaged than a competitor who has simply continued to operate without taking into account the great change underway. The second will have to pay high taxes which will have repercussions on the company’s balance sheet and stock market prices, in addition to reputational damage that could exacerbate a situation of financial stress. In a market with increasingly narrow margins, a change in legislation could also represent the coup de grace for many companies that lag behind on the issue of energy sustainability.

Transition risks can therefore be summarized as risks for a company due to the fact of not being able to comply in a timely manner with changes occurring in the regulatory framework of reference. And these risks are high for many companies, but at the same time they will be an opportunity for those who will be able to innovate and adapt to the new sustainable path marked by the United Nations 2030 Agenda and the Paris Agreement. In our own small way, we too can be careful not only to consume sustainable products but also to invest in financial assets with a high sustainability index to better preserve the value of our savings.

Sources: European Central Bank – Guide on climate and environmental risks; World Economic Forum – Global Risk Report 2020