Lately we often hear terms like Green Finance, financial sustainability, social impact bonds, SRI etc: why so many names? So what is sustainable finance?

Sustainable finance is linked to an ethical vision of long-term investment. These are investments in activities or companies that give an economic profit and at the same time have a positive impact on a social and / or environmental level. Sustainable finance is not a new concept: the first ethical banks appeared already towards the end of the 1970s. There are several models to explain this phenomenon, many of which have points of intersection:

• Socially responsible investments (SRI). This is the prevailing approach at the moment. SRI stands for Sustainable and Responsible Investment and considers the impacts of investments on the environment, society and corporate structure (known as ESG criteria). This approach leads to a responsible economy by encouraging selection companies to include in their evaluations not only the classic financial criteria but also the extra-financial ones. In general, the analysis is conducted starting from the financial statements or sustainability reports and the information provided by the company and other organizations such as trade unions, consumer associations, environmental associations and NGOs. Global net worth, according to a Morningstar research, exceeded $ 1 trillion, with a growth of 72% in the second quarter of 2020.

• Green Finance. Generally seen as the arm of the SRI, it brings together all those financial transactions that favor the transition to renewable sources and fight climate change. One of the main instruments are Green Bonds, bonds issued with the aim of financing ecological initiatives. While this market was almost non-existent in 2010, in 2019 alone Green bonds were issued for about 257.7 billion dollars (+ 51% compared to 2018). A complementary approach in Green Finance is decarbonisation: financial managers limit exposure in their portfolios to companies that have a negative impact on pollution.

• Social finance. A “social impact” is defined as finance that supports investments linked to measurable social objectives capable, at the same time, of generating an economic return for investors. Two macro-phenomena are involving the Social Services sector in an important way: the average aging of the population and the economic crisis. Social finance, therefore, seeks to bridge the gap between necessary and available resources by financing projects that would not obtain funds from “classical” finance. Among the various social finance tools we find:

- Social Impact Fund: a form of social shareholding that is achieved through funds that invest risk capital in companies or organizations with the aim of generating a measurable social or environmental impact together with a financial return.

- Social Impact Bond: also known as Pay for Success Bond, a ‘bond’ where the repayment and remuneration of the loan is conditional on the achievement of a specific social result. Applied by the Public Administration for the collection of private loans, it is particularly complex in its implementation and involves a number of actors including an independent evaluator.

- Social Bonds: traditional bonds specifically addressed to NPOs both in the sense of collected masses and the flow of donations destined for them.

- Mini Bond: bonds the issue of which does not require listing on the market. Developed with the aim of supporting small and medium-sized enterprises, they have a real potential for use also for cooperatives.

- Crowdfunding and Social Lending: forms of widespread-based financing using web platforms. They are suitable for projects, even of a certain size, promoted in particular by NPOs.

- Microfinance: small loans to non-bankable entities suitable for small private initiatives. Micro-credit has also been available for some time and used by the Third Sector.

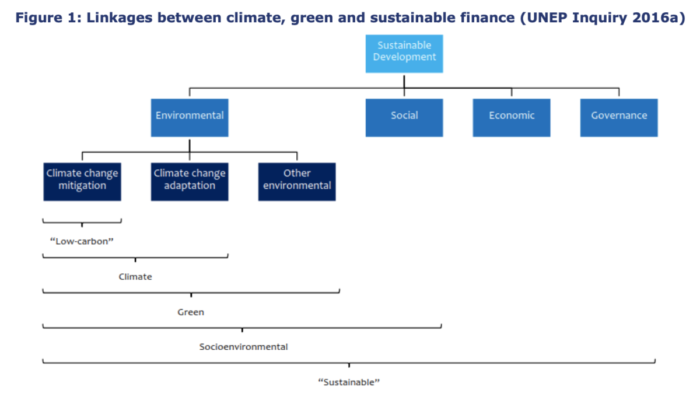

A United Nations survey visually summarizes the link between sustainable, social, Green and climate-related finance: in essence, the term “sustainable” embraces all these areas, trying to create a positive impact on an environmental, social and economic level.

Fonti: Consob, Unenvironment, Soliditas, Morning Star